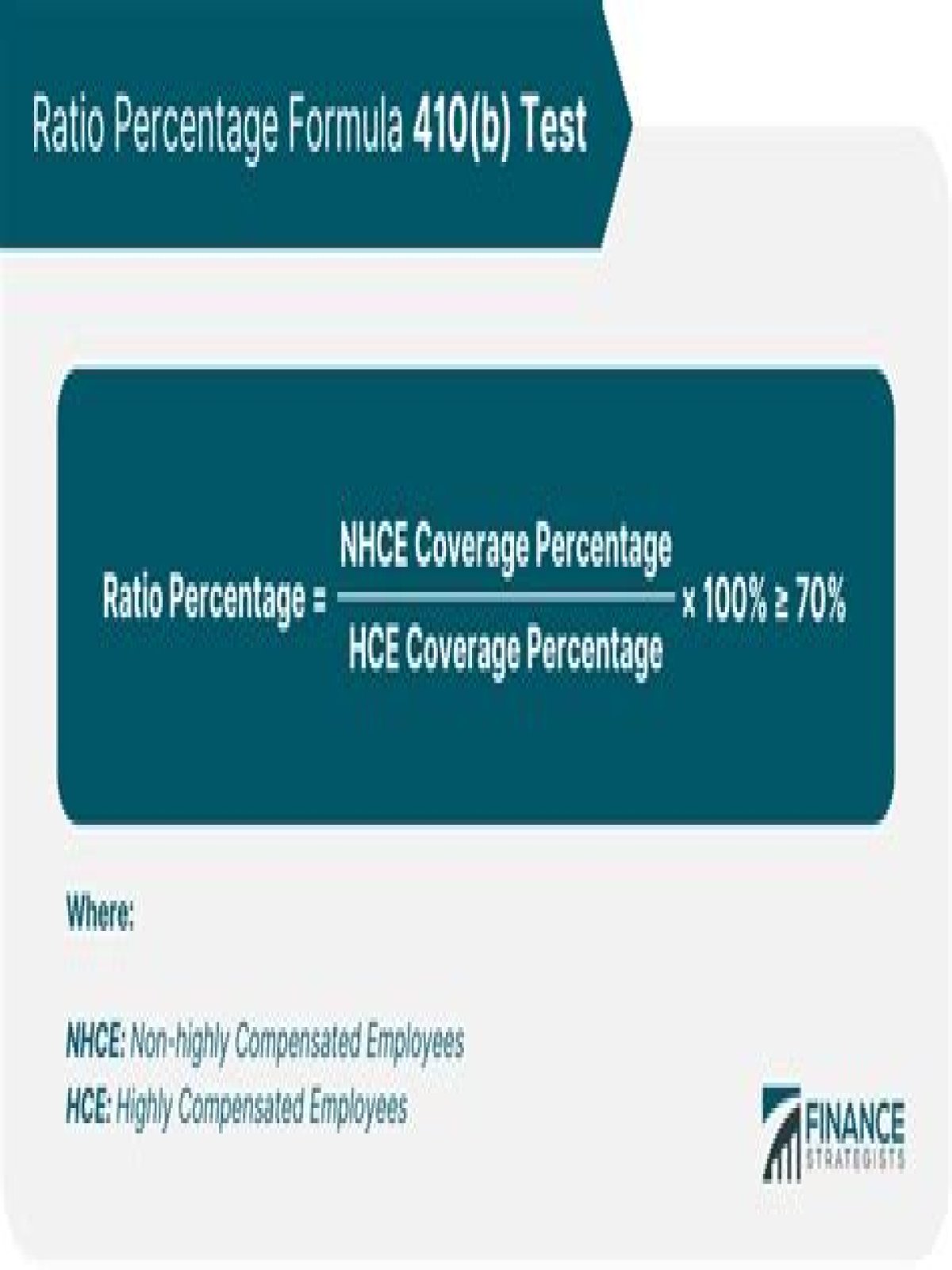

What is the ratio percentage test? The ratio percentage test is a straight numerical test comparing the ratio of NHCEs benefiting from the plan with the ratio of HCEs benefiting from the same plan. To pass this test, the coverage ratio must be 70% or higher.

- What tests are required for 403b?

- What is the 410 B coverage test?

- What is ADP testing for 401k?

- What is average benefit test?

- Do 403 B plans have to pass ACP test?

- Does 403 B Plan require top heavy testing?

- How do you correct a failed ACP test?

- How do you pass the ADP test?

- What is the 415 test?

- What is 401 A 4 a test?

- How do you fix a failed 410 B test?

- How is average benefit test calculated?

- What is the 50 40 test?

- What are highly compensated employees?

- What is nondiscrimination testing?

- How much should I contribute to 403b plan?

- Does 411 d )( 6 apply to 403 B plans?

- Can a 403b Be safe harbor?

- What plans are subject to nondiscrimination testing?

- Are 403 B plans safe?

- What is ADP and ACP testing?

- What is ACP compensation?

- What is Section 125 nondiscrimination testing?

- How is ADP calculated?

- What is the 2021 maximum 401k contribution?

- What is a top heavy 401k plan?

- What is the minimum coverage test?

- How much can highly compensated employees contribute to 401k?

- What is the maximum number of employees earning at least 5000?

What tests are required for 403b?

403(b) plan sponsors that match elective deferrals are generally required to test the matching contributions via the actual contribution percentage test (ACP). Matching contributions are divided into pay to determine the contribution ratio for each employee.

What is the 410 B coverage test?

1) 410(b) coverage testing is a “counting” form of testing, where you are basically comparing the ratio of the number of HCE’s who benefit under the plan to the total number of statutorily eligible HCEs, to a similar ratio for everyone else (who,, by process of elimination, are known as Non-highly Compensated Employees …

What is ADP testing for 401k?

These nondiscrimination tests for 401(k) plans are called the Actual Deferral Percentage (ADP) and Actual Contribution Percentage (ACP) tests. The ADP test counts elective deferrals (both pre-tax and Roth deferrals, but not catch-up contributions) of the HCEs and NHCEs.What is average benefit test?

In essence, the average benefit test permits a plan that would not otherwise pass the ratio percentage test to satisfy the Code’s coverage requirements, provided that the average benefit provided to the NHCEs is at least 70% of the average benefit provided to the HCEs.

Do 403 B plans have to pass ACP test?

Section 403(b) plans are only required to perform the ACP test since these plans are subject to the Universal Availability rule, whereby the employer generally must make the plan available to employees. (i.e., allow virtually all employees to contribute to the plan).

Does 403 B Plan require top heavy testing?

The top-heavy determination does not apply to 403(b) plans.

How do you correct a failed ACP test?

- returning the excess HCE contributions that are causing the plan to fail the test back to the HCEs, or.

- contributing additional amounts to the NHCEs.

How do you pass the ADP test?

To pass the test, the ADP of the HCE may not exceed the ADP of the NHCE by more than two percentage points. In addition, the combined contributions of all HCEs may not be more than two times the percentage of NHCE contributions.

What is the top heavy test?Top-heavy testing assesses account balances of key employees as a percentage of the total plan assets. A plan is top-heavy if account balances of key employees represent more than 60% of the account balances of all employees.

Article first time published onWhat is the 415 test?

IRS compliance testing: 415 limits testing These tests are designed to make sure the amounts employees are deferring is within certain maximum limits and that plans are not operating in a manner that discriminates against certain classes of employees.

What is 401 A 4 a test?

Section 401(a)(4) contains the test for nondiscrimination that a qualified plan must satisfy. The purpose of this test is to assure that the benefits provided to highly compensated employees are proportional to those provided to nonhighly compensated employees.

How do you fix a failed 410 B test?

Accordingly, if a Section 410(b) coverage testing failure occurs, the employer will need to explore how to correct it. The by-the-book approach to correcting such a failure is to make a contribution to other NHCEs so that more NHCEs benefit under the plan that is failing.

How is average benefit test calculated?

The average benefit percentage of a plan for a plan year is the percentage determined by dividing the actual benefit percentage of the nonhighly compensated employees in plans in the testing group for the testing period that includes the plan year by the actual benefit percentage of the highly compensated employees in …

What is the 50 40 test?

A coverage test applicable only to a defined benefit pension plans that requires the plan to cover for ever day during the plan year the lesser of 50 employees or 40% of all eligible employees.

What are highly compensated employees?

A highly compensated employee is defined as an employee that owns more than 5% of the interest in a business at any time during the year or the preceding year.

What is nondiscrimination testing?

What is nondiscrimination testing? Nondiscrimination testing requires that employees of a certain status (highly-compensated employees and Key employees) stay within a specific contribution rate, as determined by the contribution rate of NHCEs.

How much should I contribute to 403b plan?

The average goal for most people is to save around 15% of their incomes for retirement each year. Your employer match also counts toward that total. You should always take full advantage of your employer match if you have one because it’s basically free money, earmarked for your retirement.

Does 411 d )( 6 apply to 403 B plans?

Well, first of all, technically, 411(d)(6) does NOT apply to governmental plans (nor does it generally apply to ANY 403(b) plan that is not subject to ERISA—the 403(b) regulations describing the “nonforfeitable” requirement of section 403(b)(1)(C) cross-reference section 411 and the regulations, but those do not apply …

Can a 403b Be safe harbor?

There are two types of safe harbor plan designs. One type is the 403(b) safe harbor non-elective plan design. Generally, a 3 percent contribution is provided to all employees eligible to make elective deferrals to the plan. … The safe harbor contribution is immediately 100 percent vested.

What plans are subject to nondiscrimination testing?

The IRS requires non-discrimination testing for employers who offer plans governed by Section 125, which includes a flexible spending account (FSA). And though they aren’t part of Section 125, testing is also required for health reimbursement arrangements (HRAs) and self-insured medical plans (SIMPs).

Are 403 B plans safe?

A 403(b) plan can be a good way to save for retirement, typically money goes in tax-free. … So your 403(b) contributions may have less tax taken out in the long-run. That’s good news for you. Of course, if you expect to be in a higher tax bracket in retirement, then a 403(b) may not be a good option for you.

What is ADP and ACP testing?

The ADP test is an acronym for the Actual Deferral Percentage test. It is a specific non-discrimination test that applies to employee salary deferral or 401(k) contributions. Similarly, the ACP test is an acronym for the Average Contribution Percentage test.

What is ACP compensation?

ACP Compensation means for any Plan Year, Adjusted Compensation received during the Plan Year by an Eligible Employee for personal services actually rendered in the course of employment with the Employer during such Plan Year; provided, however, that at the election of the Committee, ACP Compensation may be limited to …

What is Section 125 nondiscrimination testing?

What is Section 125 Nondiscrimination Testing? Your plan allows employees to pay for their health care and dependent care expenses on a pre‐tax basis. … In order for Highly Compensated and Key employees to receive these benefits, the plan must not discriminate in their favor.

How is ADP calculated?

Each participant’s ADP is calculated by taking their total salary contributions for the calendar year (not including catch-up contributions) and dividing this number by their compensation for the same year.

What is the 2021 maximum 401k contribution?

Deferral limits for 401(k) plans The limit on employee elective deferrals (for traditional and safe harbor plans) is: $20,500 in 2022 ($19,500 in 2021 and 2020; and $19,000 in 2019), subject to cost-of-living adjustments.

What is a top heavy 401k plan?

A plan is top-heavy when the owners and most highly paid employees (“key employees”) own more than 60% of the value of the plan assets. … The employer must generally pay a minimum 3% benefit to the accounts of the lower paid employees (the “non-key employees”) if the top-heavy ratio exceeds 60%.

What is the minimum coverage test?

Internal Revenue Code Section 410(b) minimum coverage testing compares the proportion of non-highly compensated employees (NHCEs) who are covered by the plan against the proportion of HCEs who are covered by the plan, explains Mark Carolan, senior associate with Groom Law Group in Washington, D.C. If the percentage of …

How much can highly compensated employees contribute to 401k?

Highly compensated employees (HCEs) can contribute no more than 2% more of their salary to their 401(k) than the average non-highly compensated employee contribution. That means if the average non-HCE employee is contributing 5% of their salary, an HCE can contribute a maximum of 7% of their salary.

What is the maximum number of employees earning at least 5000?

What is the maximum number of employees (earning at least $5,000) that an employer can have in order to start a SIMPLE retirement plan? An employer can have a maximum of 100 employees earning at least $5,000 to be eligible for a SIMPLE retirement plan.